Shifting trade policies, central bank actions, and currency fluctuations are reshaping the emerging market (EM) debt landscape, creating both risks and opportunities for investors.

Key Insights:

- Tariff Uncertainty: U.S. tariffs on China, Mexico, and Canada, along with China’s retaliatory measures, pressured EM currencies and trade flows.

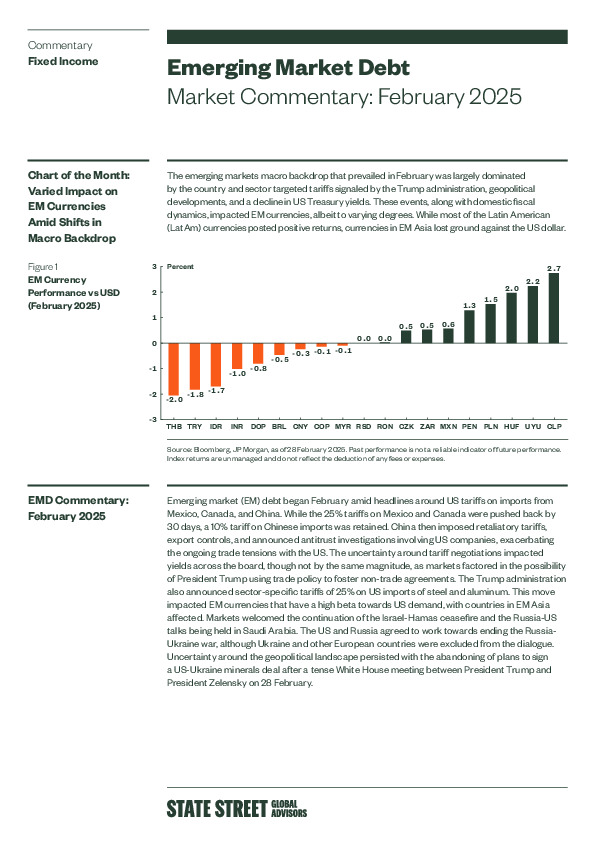

- Mixed Performance: Latin American currencies gained, while EM Asia saw declines due to trade tensions and weaker demand.

- Interest Rate Adjustments: Mexico and India cut rates to support growth, while China held steady amid economic uncertainty.

Discover opportunities in emerging market debt, explore the full report.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.