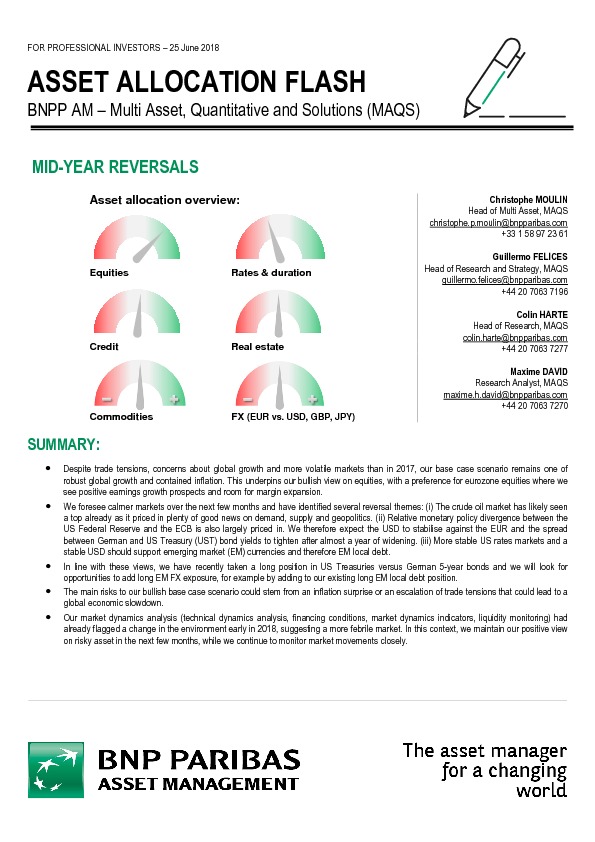

Despite trade tensions, concerns about global growth and more volatile markets than in 2017, our base case scenario remains one of robust global growth and contained inflation. This underpins our bullish view on equities, with a preference for eurozone equities where we see positive earnings growth prospects and room for margin expansion.

We foresee calmer markets over the next few months and have identified several reversal themes: (i) The crude oil market has likely seen a top already as it priced in plenty of good news on demand, supply and geopolitics. (ii) Relative monetary policy divergence between the US Federal Reserve and the ECB is also largely priced in. We therefore expect the USD to stabilise against the EUR and the spread between German and US Treasury (UST) bond yields to tighten after almost a year of widening. (iii) More stable US rates markets and a stable USD should support emerging market (EM) currencies and therefore EM local debt.

Dit artikel verder lezen?

- Exclusief voor professionele beleggers

- Altijd opzegbaar

- Onbeperkt toegang

- Exclusief voor professionele beleggers

- Altijd opzegbaar

- Onbeperkt toegang

Registreren duurt minder dan 1 minuut.

Geen betaalgegevens vereist