The State Street Weekly provides a detailed analysis of the economic and market trends influencing asset allocation strategies for 2025.

Key Insights:

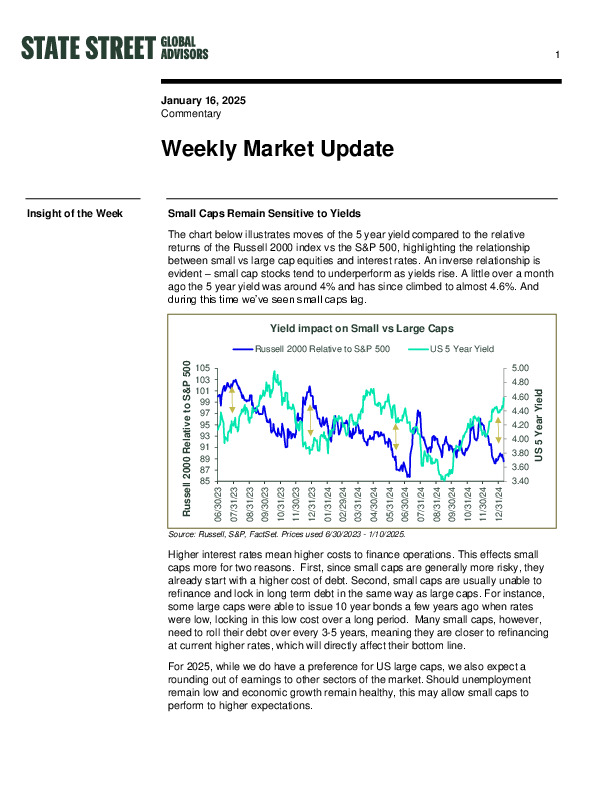

• Small Caps vs. Yields: Rising 5-year U.S. Treasury yields to 4.6% have pressured small caps, which are more sensitive to financing costs than large caps.

• Stock-Bond Correlation: The traditional negative correlation shows signs of normalization, though markets remain reactive to macroeconomic data.

• Portfolio Trends: The 60/40 portfolio gained 13.43% in 2024, supported by equity resilience and stable credit spreads.

• Sector Outlook: U.S. equities remain favored, with credit spreads signaling a stable macro backdrop.

For comprehensive insights and strategic recommendations, access the full report.