At the moment, the metrics that are being widely used to track emissions are insufficient. Scope 1 and 2 emissions calculations are widely available, but they only focus on companies’ own operations, ignoring upstream and downstream emissions, which can account for as much as 90% of overall emissions. Scope 3 emissions can solve this problem, but the data are not widely available and can be unreliable given the lack of consistent rules and disclosure requirements.

Any measurement system we adopt should consider the impact of climate change holistically, so that every step of the production cycle is systematically monitored for emissions. A value chain approach could be one way of doing that. It avoids the pitfalls of the current protocol and can enable businesses to better address emissions embedded in their products, consumers to make more informed climate choices, and investors to more effectively allocate capital.

Thinking about climate change holistically

It’s all too common to see compartmentalised thinking about carbon. Businesses may assess the emissions of their own operations but ignore those created in extracting raw materials, disposing of their products or from product lifespan planning; individuals may purchase items with recycled packaging but fail to consider the difference in emissions between locally produced and imported goods; and investors buy stocks in industries with naturally low emissions, ignoring the fact that certain high emissions sectors manufacture products and services that are essential for society and these are the industries that need to transition to low carbon ways the most.

To make better, more climate-aware choices as businesses, individuals, and investors we need to modify our concepts around emissions to be more comprehensive and holistic. We need to understand the true scale of emissions generated by the goods and services we make, use, and capitalise. A crucial part of that involves accurately measuring and tracking emissions in products.

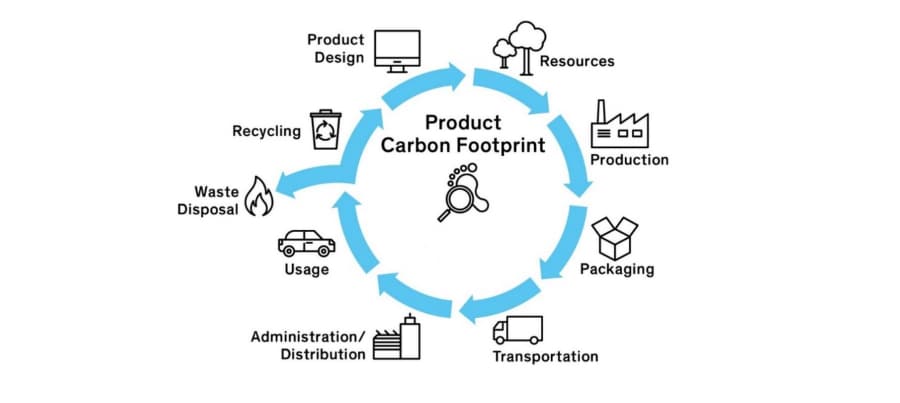

Every product goes through a number of value chain phases from the energy required to extract raw materials to the product’s disposal. If we can fully capture all emissions generated at all stages of a product or service lifecycle, we can enable businesses to better design products, consumers to make more climate-friendly choices, and investors to more effectively allocate capital to address climate change.

The pitfalls of scope 1, 2 and 3

The Green House Gas Protocol of 2001 was a ground-breaking leap forward in introducing a system that allowed us to think about emissions in a structured way. This framework advocated three spheres of tracking emissions in what is today’s widely used scope 1, 2 and 3 classifications. While the system gave industry the tools to start quantifying emissions, it is not without weaknesses.

Scope 1 and 2, which calculate the emissions generated by a business directly and indirectly, are limited to only reflecting the operations of a business. They do not capture emissions across the full value chain of a product. They also do not address how a product will affect climate change over its entire life, first as raw material building blocks, then during its use as a product, and later as waste or recycled items.

Scope 3 attempts to resolve this gap by measuring the emissions that an organisation is indirectly responsible for, up and down its value chain, from buying products from suppliers to their full use by customers. Scope 3 can account for up to 90% of total carbon emissions1, so it’s crucial we measure it accurately. But despite ongoing efforts by the industry and commercial data providers, a of the beginning of 2020, only 18% of constituents in the MSCI AC World Index reported scope 3 emissions and there was considerable variability across sectors2.

The reasons for limited scope 3 disclosures are that the data is difficult to collect from suppliers and customers, and standards vary. Another hurdle is the prevalence of double counting - when scope 1 emissions of one entity form a part of scope 3 emissions of more than one downstream entity. Another layer of double counting can happen at the level of financial institutions. This is where a portfolio manager invests in several companies in the same value chain and aggregates their scope 3 emissions. For example, a wind turbine maker’s scope 3 emissions would overlap with the scope 1 emissions of its parts supplier. If both companies were owned in a portfolio, the carbon footprint would be counted twice. For investors, double counting can reach 30-40% of a portfolio’s emissions3.

The value chain approach to emissions

In a world of imperfect data, there is no perfect solution. One way of avoiding double counting at a portfolio level is by breaking the value chain into discrete parts and assessing the carbon footprint in each section.

Value chain assessment of emissions

Source : Fidelity International, Myclimate.org, October 2021.

Source : Fidelity International, Myclimate.org, October 2021.

This value chain approach has multiple benefits. Firstly, it more accurately presents the scale of the emissions problem on an overall product level so we can understand and think about policy responses more effectively. It helps customers, whether businesses or individuals, make more informed consumption choices through better comparisons of the environmental profiles of products. For investors, it not only minimises the issue of double counting, but it can also help in making more sustainable investment decisions. For example, a portfolio manager can use this more comprehensive lens to decide which products are really more environmentally friendly or recognise where decarbonisation solutions could have the greatest impact and allocate capital accordingly.

Value chains emissions assessment in practice

The value chain emissions approach involves considering all relevant phases of a products life, including resource extraction, transport routes, manufacturing processes, packaging and distribution, customer use, waste and recycling. Breaking this value chain into its different components is the challenging part. One way to do this is by using the product’s bill of materials. While this approach is still imperfect - it is often complex, requires in-depth research and considerable investment resources - it minimises the problem of double counting, is arguably more objective by shifting the onus away from companies to third-parties to evaluate emissions, and makes for clearer comparisons.

Wuxi Lead Intelligent Equipment case study

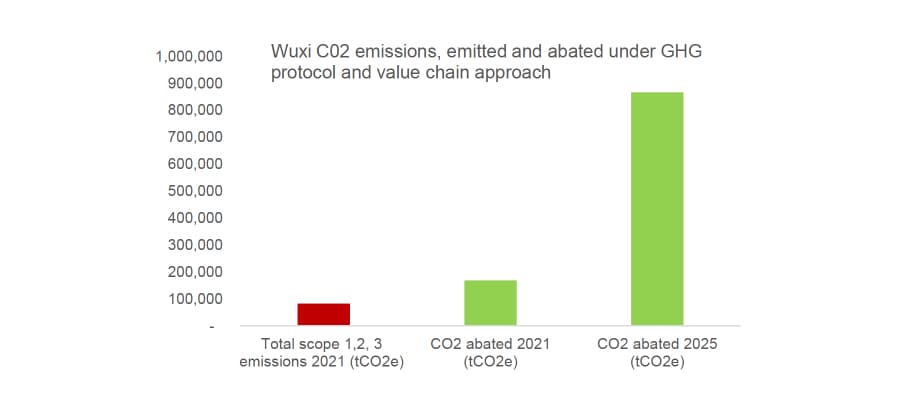

Wuxi is an electric vehicle battery manufacturing equipment maker. We calculated its annual abatement of emissions under the value chain framework by first calculating the power generated by the company’s products, then the emissions saved through their use, and finally attributing a share of the emissions avoided in the value chain to Wuxi. These are the steps we used:

1. From company filings and Fidelity’s own company and industry models, we collected the following data:

- The size of the global battery equipment installed base

- Capacity utilisation of the battery equipment installed base

- Wuxi’s market share of the global installed base

- Wuxi’s annual battery equipment sales

2. We then used Wuxi’s battery equipment installed base, global battery equipment capacity utilisation, and annual installations data to calculate the annual EV battery gigawatts produced using the company’s equipment.

3. Using data from 2 and 3, we calculated the number of EVs that have been produced per year using batteries manufactured with Wuxi’s equipment. Assuming a 15-year life of a vehicle, we added the historical annual vehicle sales to current production to calculate the installed base of EVs with batteries manufactured using the company’s equipment.

4. The annual CO2 abatement by the installed base of EVs on the road during the year was computed based on the assumption that each EV replaces an equivalent size internal combustion engine (ICE) vehicle. The CO2 emissions avoided are equal to the difference between emissions of an average sized EV and an ICE based on the current power generation mix globally. The avoided emissions are calculated on a full lifecycle basis, rather than the in-use phase only, and sourced from a number of third-party organisations.

5. To avoid double counting we attributed the emissions avoided in step 5 to players along the EV value chain. We assigned an attribution share to Wuxi based on our estimate of the value addition attributable to the company. To calculate the CO2 emissions saved annually and attributable to Wuxi, we multiplied this attribution factor to total CO2 emissions saved.

Wuxi’s emissions profile under a value chain framework

Source : Fidelity International, 31 July 2021. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

Source : Fidelity International, 31 July 2021. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

The implications of value chain emissions for investors

We already highlighted that value chain assessment minimises the issue of double counting emissions in portfolios and helps investors make better sustainable investment decisions by comparing different products’ CO2 footprints. Importantly, it also subtly shifts the debate away from merely avoiding emissions and towards active decarbonisation.

As investors, we should be moving beyond simply looking at the absolute emissions level of a portfolio as it is relatively easy to design a fund with low emissions, but which makes little difference to climate change. By excluding certain industries, a manager can have a low carbon footprint without encouraging companies to become cleaner or invest in transitioning to a low carbon world - the approach effectively side-lines the problem.

A transitions-based investment philosophy invests in companies with the most ambitious targets that can act as leaders in an industry. Orsted, an energy supplier that has transformed into the leading wind power provider, is an example of an industry leader that is influencing other companies such as Equinor to follow in its footsteps. Investing in these types of businesses can have a far bigger net benefit on emissions than investing in companies with inherently low emissions such as media companies.

A decarbonisation solutions strategy can have an even more profound effect. This approach seeks to invest in technologies that facilitate low carbon transitioning across entire industries, reducing the costs of becoming cleaner not only for public businesses but also for private enterprises and government/non-profit entities. A decarbonisation solutions fund may have higher or lower emissions than a benchmark, depending on sector allocation, but its objective is to support lower future emissions for society as a whole and ultimately have a significant impact on combatting climate change. A value chain emissions framework illustrates the impact of the decarbonisation solutions approach.

Towards decarbonising our world

The Green House Gas Protocol of 2001 has made a huge contribution towards tackling climate change by giving us our first quantitative framework for analysing emissions. But achieving full transparency and accuracy of emissions calculations in accordance with the protocol is likely to take a long time and substantial effort. Until then, the value chain emissions framework is a robust way to clarify product emissions and calculate the true impact of portfolios.

Tracking emissions from a value chain perspective supports a self-reinforcing system to decarbonise: it helps consumers make more informed comparisons between the climate costs of different products so that businesses have a commercial imperative to improve, and it provides investors with more complete information to allocate climate-aware capital. It may be the approach we need as the world wakes up to the monumental climate challenge in front of us.

References

1 Carbon Trust: Make business sense of Scope 3 https://www.carbontrust.com/news-and-events/insights/make-business-sense-of-scope-3

2 Scope 3 emissions and double counting: Fair allocation of supply chain emission https://gireeshshrimali.medium.com/scope-3-emissions-and-double-counting-fair-allocation-of-supply-chain-emissions-221baeeeb18b

3 Institutional Investors Group on Climate Change (IIGNCC) https://www.iigcc.org/resource/carbon-compass-investor-guide-to-carbon-footprinting/

Important Information

This information must not be reproduced or circulated without prior permission.

Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client.

Fidelity International refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required.

Unless otherwise stated all products and services are provided by Fidelity International, and all views expressed are those of Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are registered trademarks of FIL Limited.

Continental Europe: We recommend that you obtain detailed information before taking any investment decision.

Denmark/Finland/Italy/Luxembourg/Norway/Portugal/Spain/Sweden: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which is available along with the current annual and semi-annual reports free of charge from our distributors and from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg.

Austria: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports free of charge from our distributors and from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg as well as from the paying agent in Austria, UniCredit Bank Austria AG, Schottengasse 6-8, 1010 Vienna, or on www.fidelity.at.

Belgium: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which is available along with the current annual and semi-annual reports free of charge from our distributors, from FIL (Luxembourg) S.A. and CACEIS België NV, with head office at Havenlaan 86C, B320, 1000 - Brussels, the financial service provider in Belgium.

Czech Republic: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which is available along with the current annual and semi-annual reports free of charge from our distributors, from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg and from our paying agent UniCredit Bank Czech Republic a.s., Zeletavska 1525/1, 14092 Prag 4 - Michle, Czech Republic. The KIID is available in Czech language.

Croatia: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports free of charge from our distributors, from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg and from our paying agent Zagrebačka banka d.d., Trg bana Josipa Jelačića 10, 10000 Zagreb.

France: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which is available along with the current annual and semi-annual reports free of charge upon request at FIL Gestion, authorised and supervised by the AMF (Autorité des Marchés Financiers) N°GP03-004, 21 Avenue Kléber, 75016 Paris. The document is available in French upon request. If you do not wish to receive documents in English dedicated to Professional, please contact your Fidelity contact.

Germany: Any performance disclosure is not compliant with German regulations regarding retail clients and must therefore not be handed out to these. Investments should be made on the basis of the current prospectus/Key Investor Information Document (KIID), which is available along with the current annual and semi-annual reports free of charge from FIL Investment Services GmbH, Postfach 200237, 60606 Frankfurt/Main or www.fidelity.de.

Hungary: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which is available along with the current annual and semi-annual reports free of charge from our distributors, from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg and from our distributor Raifeisenbank Zentralbank Österreich AG, Akademia u. 6, 1054 Budapest. The KIID is available in Hungarian language.

Ireland: Investments should be made on the basis of the prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports at www.fidelity.ie. Issued by FIL Fund Management (Ireland) Limited, which is authorised and regulated by the Central Bank of Ireland (the “Central Bank”) as a management company pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011 (S.I. 352 of 2011), as amended. The Company is also authorised by the Central Bank as an Alternative Investment Fund Manager pursuant to the European Union (Alternative Investment Fund Managers) Regulations 2013, as amended (S.I. 257 of 2013). Registered office of FIL Fund Management (Ireland) Limited is Georges Quay House, 43 Townsend Street, Dublin 2, DO2 VK65.

Liechtenstein: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports free of charge from our distributors, from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg as well as from the paying agent in Liechtenstein, VP Bank AG, Äulestrasse 6, 9490 Vaduz.

Netherlands: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports free of charge from our distributors, and from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg. In the Netherlands, documents are available from FIL (Luxembourg) S.A., Netherlands Branch (registered with the AFM), World Trade Centre, Tower H, 6th Floor, Zuidplein 52, 1077 XV Amsterdam (tel. 0031 20 79 77 100). The Fund is authorised to offer participation rights in the Netherlands pursuant to article 2:66 (3) in conjunction with article 2:71 and 2:72 Financial Supervision Act.

Poland: This material does not constitute a recommendation within the meaning of the Regulation of the Polish Minister of Finance Regarding Information Constituting Recommendations Concerning Financial Instruments or Issuers Thereof dated October 19, 2005. No statements or representations made in this document are legally binding on Fidelity or the recipient and do not constitute an offer within the meaning of the Polish Civil Code Act of 23 April 1964. Investments should be made on the basis of the current prospectus, the KIID (key investor information document) and the Additional Information for Investors, which are available along with the current annual and semi-annual reports free of charge from our distributors, from our European Service Centre in Luxembourg FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg, from the representative office in Poland or on www.fidelity.pl.

Romania: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the current annual and semi-annual reports free of charge from our distributors and from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg. The KIID is available in Romanian language.

Slovakia: Investments should be made on the basis of the current prospectus and KIID (key investor information document), which is available along with the current annual and semi-annual reports free of charge from our distributors, from our European Service Centre in Luxembourg, FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg and from our paying agent UniCredit Bank Slovakia, a.s., Sancova 1/A 81333, Slovakia. The KIID is available in Slovak language.

Switzerland: Fidelity undertakes the financial services of purchasing and/or selling financial instruments within the meaning of the Financial Services Act (“”FinSA”“). Fidelity is not required to assess the appropriateness and suitability under FinSA. Investments should be made on the basis of the current prospectus and KIID (key investor information document), which are available along with the articles of incorporation as well as the current annual and semi-annual reports free of charge from our distributors, from our European Service Center in Luxembourg FIL (Luxembourg) S.A. 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg and from the representative and paying agent in Switzerland, BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. The information provided in this marketing material constitutes an advertisement. The information provided in this marketing material should not be construed as an offer or a solicitation of an offer to purchase or sell the financial products mentioned in this marketing material.

Issued by: FIL (Luxembourg) S.A., authorised and supervised by the CSSF (Commission de Surveillance du Secteur Financier) / FIL Investment Switzerland AG / FIL Gestion, authorised and supervised by the AMF (Autorité des Marchés Financiers) N°GP03-004, 21 Avenue Kléber, 75016 Paris. For German Wholesale clients issued by FIL Investments Services GmbH, Kastanienhöhe 1, 61476 Kronberg im Taunus. For German Institutional clients issued by FIL (Luxembourg) S.A., 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg. For German Pension clients issued by FIL Finance Services GmbH, Kastanienhöhe 1, 61476 Kronberg im Taunus.

GLEMUS3872-0122