Fidelity International has joined other investors in pledging to work to eliminate commodity-driven deforestation from its investments by 2025. But how to make this commitment a reality? Our sector analysts and sustainable investing team have long engaged with companies on the issue, especially in relation to palm oil, and support the use of satellites to spot where natural forest is being destroyed so that it can be stopped.

Palm oil is efficient but can be deadly

Elaeis guineensis, the fruit of palm trees, releases a pale, odourless oil that has a high evaporation point and a long shelf life. Palm oil’s very blandness makes it the ideal additive. It is in almost half of all consumer products and demand is set to double by 2050.[1]

But palm oil can have a devastating environmental cost. Swathes of tropical rainforests from Asia to Latin America have been felled to make room for plantations, pushing species like orangutans and pygmy elephants towards extinction. Because forests absorb a third of global CO2 emissions, the deforestation caused by palm oil plantations also exacerbates climate change.[2]

There are alternatives to palm oil, but none share its unique characteristics and productive efficiency. Its fruit yields at least four times more oil than other plant sources (see chart 1). This makes it hard to replace. Alternatives such as soya are also linked to deforestation, but their lower yield per hectare mean that even more trees are at risk.

Governments and companies are waking up to the scale of the damage inflicted by palm oil growers, among others. More than 110 country leaders at the UN’s November climate conference in Glasgow (COP26) committed to end and reverse deforestation by the end of the decade. While this is promising, progress is not guaranteed. A previous deal signed in 2014 failed to dent the pace at which trees were being cut down.

In this context, the role of investors remains critical and Fidelity International, alongside more than 30 other financial companies, has agreed to strive to eliminate agricultural commodity-driven deforestation in its investment portfolio and financing activities by 2025, through various measures including engagement with the most exposed firms, disclosing that activity and increasing investment in nature-based solutions.

Satellite use can slow pace of destruction

Making palm oil sustainable won’t be easy. Palm oil supply chains are notoriously long, spanning millions of smallholder farmers, large plantation owners, oil refiners, commodity traders, and eventually consumer and industrials companies. Every part of the chain needs to act to end deforestation.

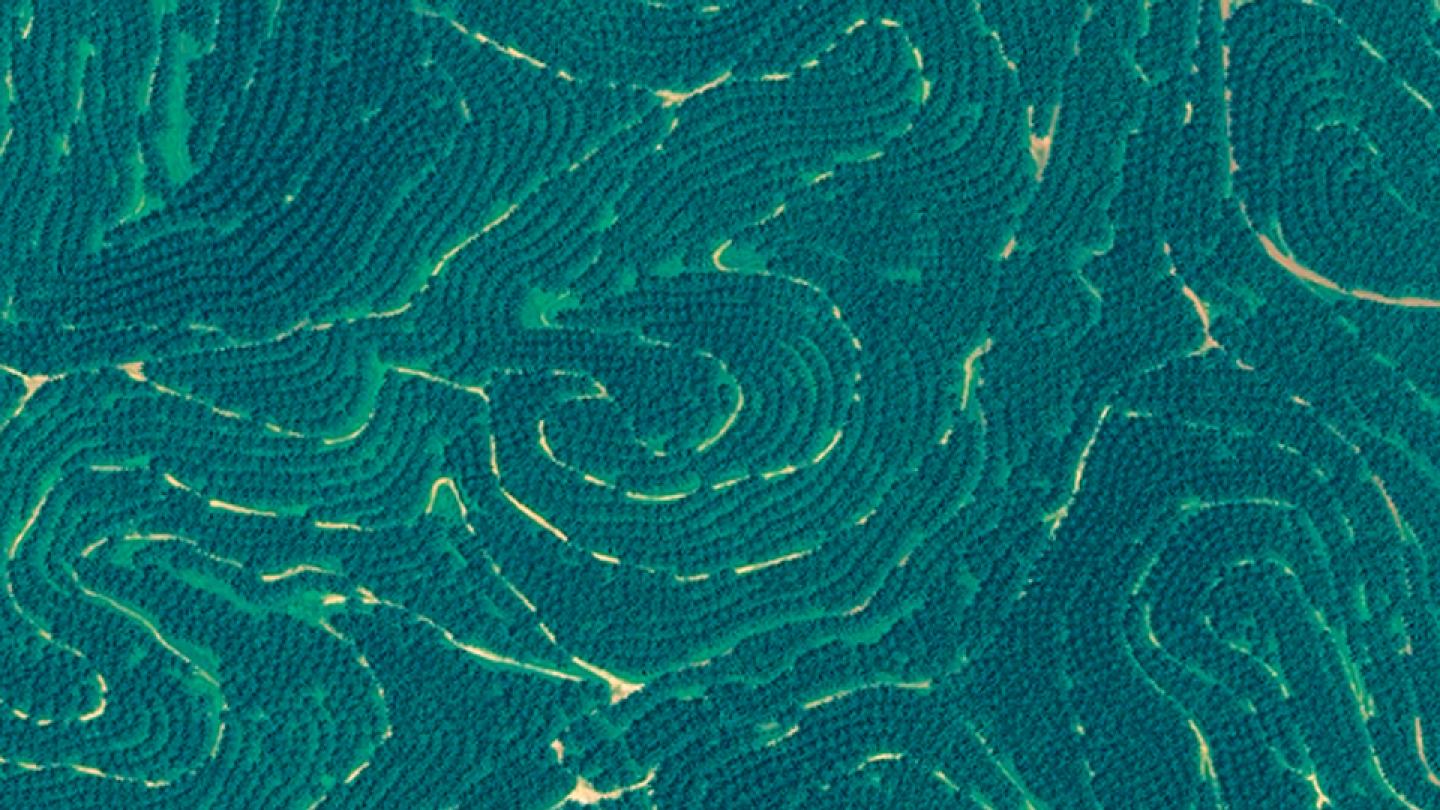

Help is at hand from satellite technology. Buyers of palm oil are deploying ‘spies in the sky’ to scan for evidence of deforestation that they can then use to compel suppliers to change their practices. These detailed satellite images require on-the-ground verification to be truly effective. And they don’t automatically prevent further deforestation or the selling of oil to markets where price is more important than provenance. Nonetheless, they are an important tool in trying to arrest the pace of destruction.

A recent study[3] found that tree loss had been reduced by half after Global Forest Watch, a monitoring body run by the not-for-profit World Resources Institute, provided indigenous communities in the Peruvian Amazon with satellite evidence of commercial deforestation on their land. The evidence was later confirmed by community forest patrols.

Collaboration is key

Moreover, collaborative deforestation engagements using satellites have shown results. Fidelity’s sustainable investing team participated in the Satellite-based Engagement Towards Deforestation, a group initiative led by Dutch asset manager ACTIAM. The group used analytics provided by Dutch start-up Satelligence to push companies sourcing palm oil from Malaysia to end deforestation in their supply chains. Many firms responded proactively and investigated the cases we shared with them.

While this kind of monitoring is not a silver bullet for ending tree felling, the innovation around the engagement was recognised at the UK’s Environmental Finance Awards 2021, where it won ‘ESG Engagement Initiative of the Year’. And we used our experience from it to share best practice across different industries that use or produce palm oil.

Engaging down the supply chain

One example was our sector analyst’s engagement with AAK, a Swedish oils and fats company, on the use of satellite technology. Palm oil is one of AAK’s most important raw materials and it purchases 80 per cent of it from refiners, with a fifth sourced directly from mills in Mexico and Colombia.

During our engagement with the company earlier this year, we asked CEO Johan Westman how AAK was ensuring its palm oil was on track to become entirely deforestation-free by 2025, a key target set by the company. Just under 70 per cent of its palm oil met this criterion in 2021, up from 50 per cent the year before.[4]

AAK told us that it was scaling up its satellite monitoring programme to improve traceability throughout its palm oil supply chain. Since our engagement, it has partnered with Satelligence and environmental consultancy Earthqualizer to use satellites to identify deforestation, logging cases as grievances with suppliers and engaging with them to improve their practices. If engagement yields no results, AAK will consider suspending the relationship.

Today, AAK’s entire supply base is covered by satellite monitoring.[5] We were encouraged that our discussion with the company was followed by concrete action and will continue to monitor AAK’s progress towards its target. Other firms are also expanding how they use the technology. Singaporean agricultural firm Wilmar now uses NASA data daily to identify fires and improve early detection of forest destruction.

A colossal challenge requires everyone to act

Ending palm oil deforestation is a mammoth task that cannot be undertaken alone. The collective commitments made at COP26 are steps in the right direction. But the size and complexity of palm oil supply chains mean that high level pledges will only be met if every link works together to root out the underlying causes of deforestation. In turn, investors have a role to play in encouraging companies to make use of tools like satellite monitoring, act on the information it provides, and work with peers and NGOs to create a palm oil industry that is free from deforestation and allows nature to flourish.

With contributions from Emma Cunningham.

[1] ‘Investors turning up the heat on Asia’s palm oil buyers,’ UNPRI, March 2020.

[2] ‘Financial sector commitment letter on eliminating commodity-driven deforestation,’ UNFCC, 2 November 2021.

[3] ‘Satellite-based deforestation alerts with training and incentives for patrolling facilitate community monitoring in the Peruvian Amazon’, PNAS, 20 July 2021.

[4] ‘All about better sourcing of palm,’ AAK, 2021.

[5] Ibid.

Important Information

This document is for Investment Professionals only and should not be relied on by private investors.

This document is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior permission of Fidelity.

This document does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, or an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties.

This communication is not directed at, and must not be acted on by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity is not authorised to manage or distribute investment funds or products in, or to provide investment management or advisory services to persons resident in, mainland China. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers.

Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Investors should also note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this documentation is gathered by Fidelity for its use as an investment manager and may have already been acted upon for its own purposes. This material was created by Fidelity International.

Past performance is not a reliable indicator of future results.

This document may contain materials from third-parties which are supplied by companies that are not affiliated with any Fidelity entity (Third-Party Content). Fidelity has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content.

Fidelity International refers to the group of companies which form the global investment management organization that provides products and services in designated jurisdictions outside of North America Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances.

Issued in Europe: Issued by FIL Investments International (FCA registered number 122170) a firm authorised and regulated by the Financial Conduct Authority, FIL (Luxembourg) S.A., authorised and supervised by the CSSF (Commission de Surveillance du Secteur Financier) and FIL Investment Switzerland AG. For German wholesale clients issued by FIL Investment Services GmbH, Kastanienhöhe 1, 61476 Kronberg im Taunus. For German Institutional clients issued by FIL (Luxembourg) S.A., 2a, rue Albert Borschette BP 2174 L-1021 Luxembourg.

In Hong Kong, this document is issued by FIL Investment Management (Hong Kong) Limited and it has not been reviewed by the Securities and Future Commission. FIL Investment Management (Singapore) Limited (Co. Reg. No: 199006300E) is the legal representative of Fidelity International in Singapore. FIL Asset Management (Korea) Limited is the legal representative of Fidelity International in Korea. In Taiwan, Independently operated by FIL Securities (Taiwan ) Limited, 11F, 68 Zhongxiao East Road., Section 5, Xinyi Dist., Taipei City, Taiwan 11065, R.O.C Customer Service Number: 0800-00-9911#2 .

Issued in Australia by Fidelity Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL No. 409340 (“Fidelity Australia”). This material has not been prepared specifically for Australian investors and may contain information which is not prepared in accordance with Australian law.

ED21 - 153